- Founder Weekly

- Posts

- Founder Weekly (Issue 718 February 11 2026)

Founder Weekly (Issue 718 February 11 2026)

Welcome to issue 718 of Founder Weekly. Let's get straight to the links this week.

Better prompts. Better AI output.

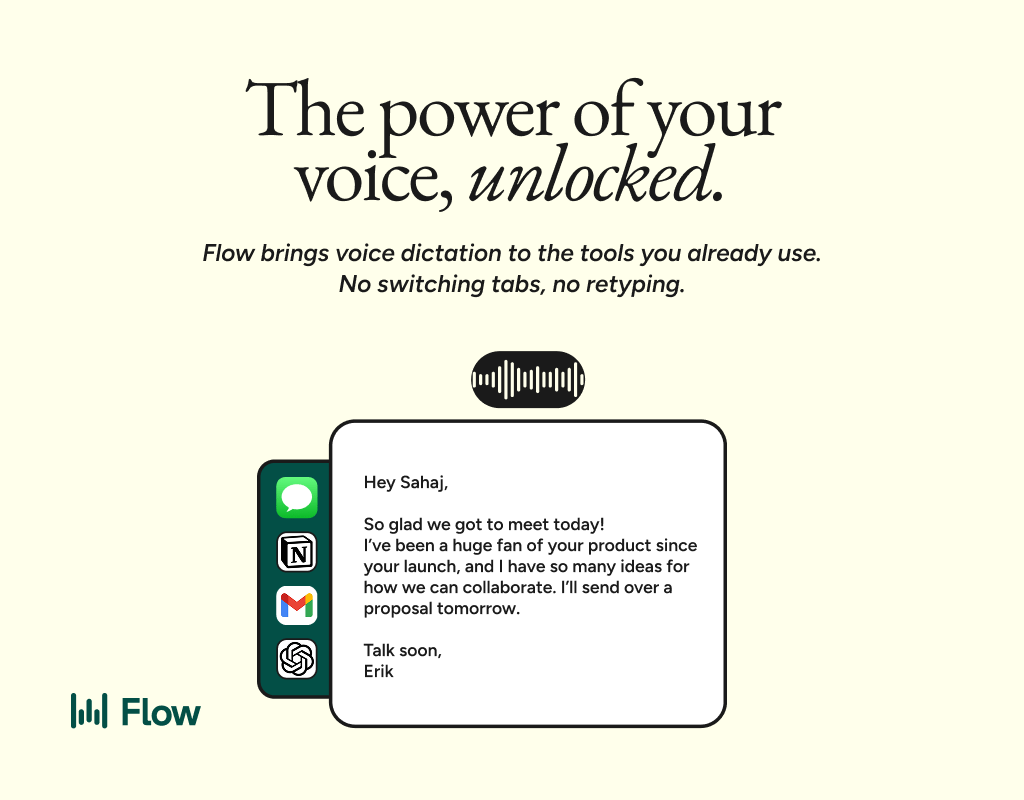

AI gets smarter when your input is complete. Wispr Flow helps you think out loud and capture full context by voice, then turns that speech into a clean, structured prompt you can paste into ChatGPT, Claude, or any assistant. No more chopping up thoughts into typed paragraphs. Preserve constraints, examples, edge cases, and tone by speaking them once. The result is faster iteration, more precise outputs, and less time re-prompting. Try Wispr Flow for AI or see a 30-second demo.

General

Alex Bouaziz (Deel CEO) shared a manifesto explaining how Deel scaled to $1B revenue with zero offices, proving remote-first is a structural superpower. Core ideas are hire self-starters who can go 0 → expert fast, demand visible impact in 30 days, make every manager a practitioner, kill underperformers via OKRs, and use intentional offsites for connection.

The essay is an interactive, practical tutorial that uses the Cursor coding agent to help readers develop real AI product intuition by building and interacting with AI workflows and a personal AI operating system rather than just reading theory. It emphasizes learning by doing, inspecting model behavior and tool calls, and understanding context, memory, and retrieval intuition so you can predict what AI products will actually work and matter for users.

AI agents are likely to commoditize and displace much of horizontal SaaS by replicating generic workflows cheaply and flexibly without dedicated tools. This post argues that vertical SaaS remains durable because regulation, domain expertise, proprietary data, liability, and deep industry relationships create moats that general AI agents cannot easily cross.

Marketing, Sales and PR

Liz Wessel posted a tactical guide on creating weighted pipeline reports to replace guesswork revenue forecasts with data-driven projections. It shows clear before/after examples, stresses realistic stage-based close rates, deal timing, and confidence weighting; huge upgrade for early-stage founders managing sales ops.

The report analyzes data from 200 B2B software products to show that the median free-to-paid conversion rate is about 8 percent, with free trials that require a credit card converting at around 30 percent compared to much lower rates for other models. It also finds free trials are much more common than freemium or reverse trials, and that neither model outperforms the other once signup rates are factored in, so product teams should pick models based on specific adoption and conversion goals.

Z Reitano, CEO of Ro, shares a deep dive into the economics of Ro’s first Super Bowl ad starring Serena Williams. Roughly $7 to $10M in airtime plus production and talent costs puts the total at $16 to $23M for 30 seconds that reaches over 100M engaged viewers in a rare cultural moment where ads themselves are the entertainment. He frames it as an asymmetric bet with downside capped at a 1 to 5 percent marketing efficiency loss if it flops, but upside uncapped through compressed brand awareness, lower future CAC, and compounding ad performance, making the math work for a scaling DTC health brand.

Money and Finance

The article argues that traditional VC’s short 5–7 year horizons are fundamentally mismatched with the decades-long timelines required for reindustrialization, hard tech, and true “American Dynamism. The author makes the case for permanent/patient capital structures instead, weaving in finance, culture, and the ironic reality that massive consumer surplus (e.g., everyone “owns a Gulfstream”) may not translate into outsized investor returns.

Erik Torenberg shares an article arguing that venture capital can scale: companies are staying private longer, reaching massive size, and creating more “mega-outcomes,” so there’s room for bigger VC funds to deploy capital effectively. The piece pushes back on the idea that the VC model is inherently broken or un-scalable, claiming the market opportunity is actually growing with it.

Michael Dempsey argues that the typical venture-backed startup path has lost cultural status because it has become the default, legible, and optimized thing to do, just like investment banking did, which makes it less interesting and signals little about who you are. He says this erosion is driven by institutional optimisation, cultural exhaustion, and a loss of originality, and that future status may hinge on things like values alignment and community rather than default startup signalling.

Our Other Newsletters |

Python Weekly - A free weekly newsletter featuring the best hand curated news, articles, tools and libraries, new releases, jobs etc related to Python. |